tucson sales tax on food

Prepared food including hot meals or deli meals like sandwiches are generally. 1-800-870-0285 email protected.

The Coupons App 1 Most Popular Download For Android Iphone Fast Food Coupons Free Printable Coupons Printable Coupons

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax.

. As you can see to obtain a foodbeverage tax in Tucson Arizona FoodBeverage Tax you have to reach out to multiple. The South Tucson Arizona sales tax is 1000 consisting of 560 Arizona state sales tax and 440 South Tucson local sales taxesThe local sales tax consists of a 050 county sales tax. As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance.

Its sales-tax revenue fell from 21 million in fiscal year 2008 to 18 million in fiscal year 2013 and the largest share comes from the retail trade category that includes the. The minimum combined 2022 sales tax rate for Tucson Arizona is 87. The burden of proving that a sale of personal property is not.

If you need to buy a big-ticket item say a new refrigerator you could save some money by buying where the sales tax is lower. A half-cent sales tax increase is estimated to cost each household member in the City of Tucson approximately 3 per month over the course of the five-year period. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3.

2020 rates included for use while preparing your income. The Tucson sales tax rate is. The sales tax jurisdiction name is Arizona which may refer to a local government division.

Wayfair Inc affect Arizona. The December 2020 total local sales tax rate was also 8700. While Arizonas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

You can print a 87 sales tax table. Tucson Sales Tax Rates for 2022. There is no applicable special tax.

Sales Affiliates and Partnerships. A 1500 refrigerator purchased in. The Tucson sales tax rate is 26.

The current total local sales tax rate in Tucson AZ is 8700. 520-792-2424 Normal Business Operations Monday - Friday 800am - 500pm. This page describes the taxability of.

The Arizona sales tax rate is currently 56. Currently the City of Tucson receives 2 percent retail sales tax. Rates include state county and city taxes.

Imposes a 400 transient rental tax on rent from persons renting accommodations for less than 30 consecutive days and a 1 per night charge per room rented but not as a part of the. Tucsons sales tax rate is 26 which is over 1000 on a typical new car. Tucson and Mesa tax food.

Did South Dakota v. Its sales-tax revenue fell from 21 million in fiscal year 2008 to 18 million in fiscal year 2013 and the largest share comes from the retail trade category that includes the food tax. The nations sixth-largest city is ready to begin phasing out an emergency sales tax on food that was added in 2010 to address a massive budget deficit.

Vehicle purchases can be made at Jim Click Ford in Sahuarita Oracle Ford in Pinal County in Nogales. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. The latest sales tax rates for cities starting with A in Arizona AZ state.

This is the total of state county and city sales tax rates. According to the Arizona Department of Revenue any food that falls within the guidelines of the Food Stamp Act of 1977 or that would have fallen into that bills purview. South Tucson City Hall 1601 South Sixth Avenue South Tucson Arizona 85713.

Tucson the seller owes the sales tax to the City of Tucson whether or not the seller added sales tax to the price of the items sold. The County sales tax rate is 0. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax.

The Tucson Sales Tax is collected by the merchant on all qualifying sales made. 4 Tax Amount Column 5 Net Taxable Column 3 From Sch A on back - Deductions Complete Both Sides of Form Column 2 THIS RETURN IS DUE ON.

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 7 Free To Download And Print Tax Printables Sales Tax Tax

Is Food Taxable In Arizona Taxjar

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

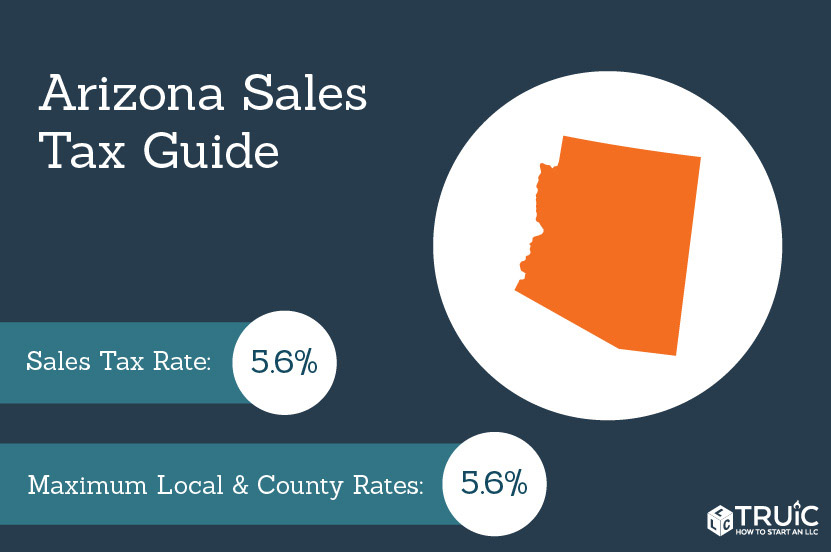

Arizona Sales Tax Small Business Guide Truic

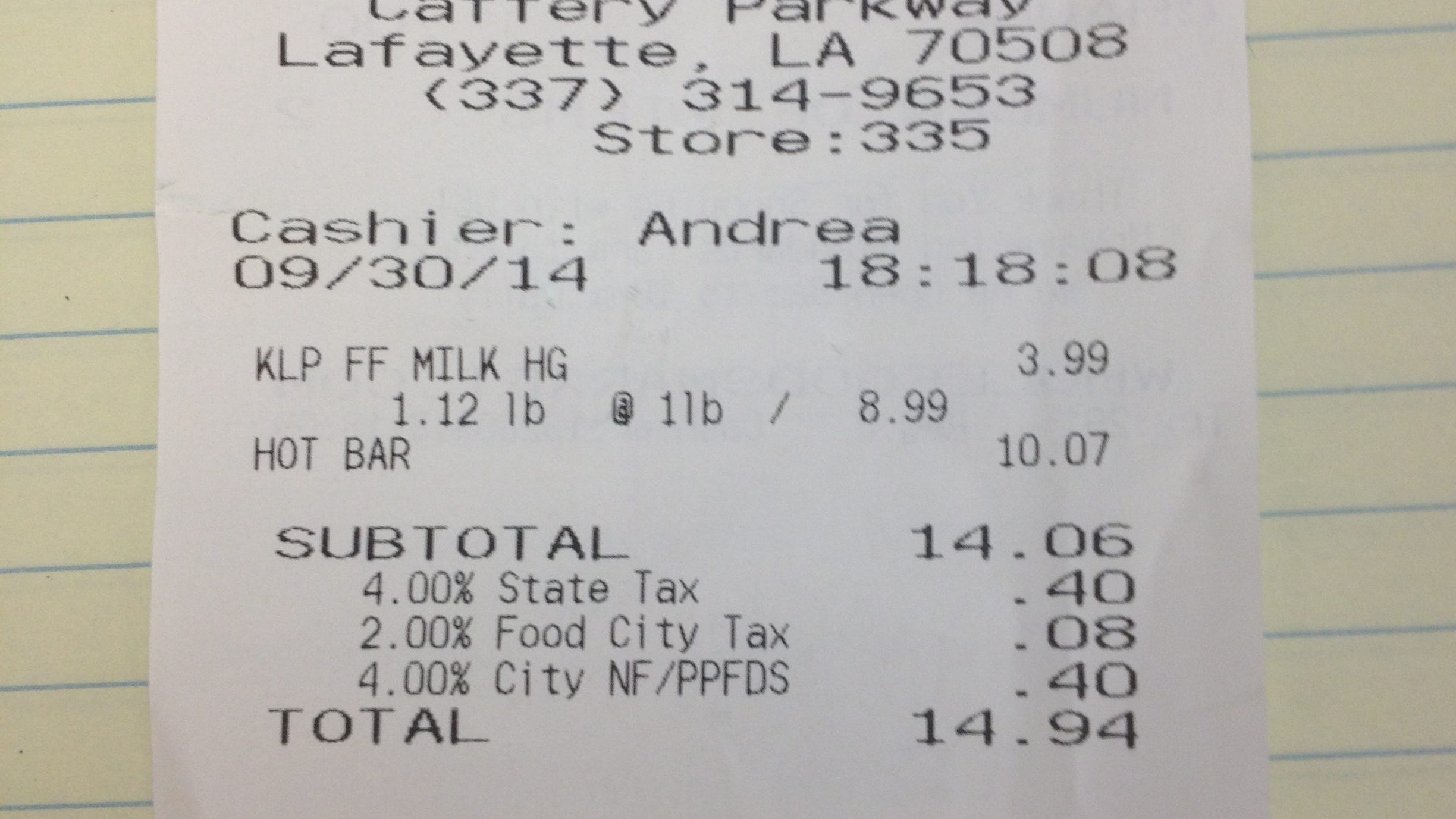

Whole Foods Collecting The Right Amount Of Sales Tax

Tucson Az Latinosover40tucson Cookies Cocktails 2020 Hosted By Girl Scouts Of Southern Arizona And Playground Bar Lounge W Girl Scouts Cocktails Tucson

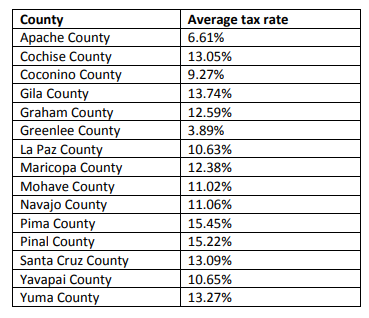

State And Local Taxes In Arizona Lexology

Arizona Sales Tax Small Business Guide Truic

Borderlands Food Bank Nogales Az 85621 Reduce Food Waste Nogales Food Waste

Restaurants And Bars Arizona Department Of Revenue

Artistic And Quirky A Walking Tour Of Barrio Viejo In Tucson Local News Tucson Com Walking Tour Texas Rangers Tucson

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

State And Local Sales Taxes In 2012 Tax Foundation

What Transactions Are Subject To The Sales Tax In Arizona

2021 2022 Sources Of Funds And Uses Of Tax Dollars Pima C

How To Calculate Sales Tax Video Lesson Transcript Study Com

3 99 For A Qt Lunch Bye Waffle House So Hot And Tasty Waffle House Quick Meals Thank You Come Again